New Report: Planetary Solvency – Finding Our Balance with Nature

"More than half the suitable land for growing wheat and maize could be lost."

Planetary Solvency – Finding Our Balance with Nature

This report, published in January 2025, is a collaborative effort led by Sandy Trust, Lucy Saye, Oliver Bettis, and others, supported by IFoA and the University of Exeter.

It outlines an urgent need for global risk management practices to mitigate climate and nature risks, employing principles from actuarial science and systemic risk methodologies. The team aims to redefine global policy priorities by integrating ecological and societal interdependencies.

The authors, as actuaries, bring a unique ability to systematically assess long-term, complex risks under uncertainty, applying structured methodologies like reverse stress testing and risk appetite frameworks. Their expertise in modeling low-probability, high-severity "tail risks" offers valuable insights into cascading tipping points and systemic failures often overlooked in policy.

Importantly, many actuaries are more realistic than traditional economists about the interdependency between the environment and the economy.

Economic dependency on nature is unrecognised in dominant economic theory which fails to recognise energy, food and other raw materials as factors of production.

Critical threats and realities highlighted in the report

- Climate impacts are occurring at lower temperatures than models predicted, with risks of mass migration, mortality, and conflict escalating rapidly.

- The Paris Agreement's 1.5°C target lacks a realistic assessment of risks, with many tipping points already nearing activation.

- By 2050, catastrophic or extreme climate impacts are likely or highly likely.

- 50% of suitable land for wheat and maize could be lost if Atlantic Ocean circulation collapses, threatening food security globally.

- Sea-level rise, extreme weather, and biodiversity loss are expected to drive severe economic shocks and resource conflicts.

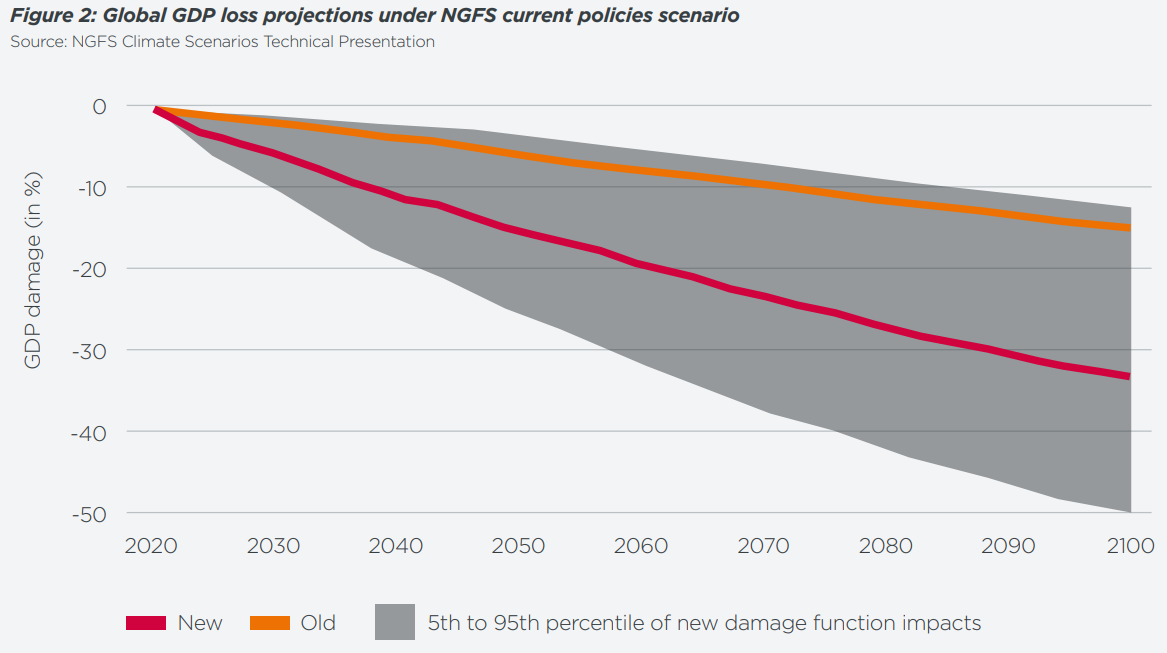

- Conventional climate models underestimate economic losses, with potential GDP losses of 15–44% by 2050.

Global risk management is currently failing and blind to systemic risk